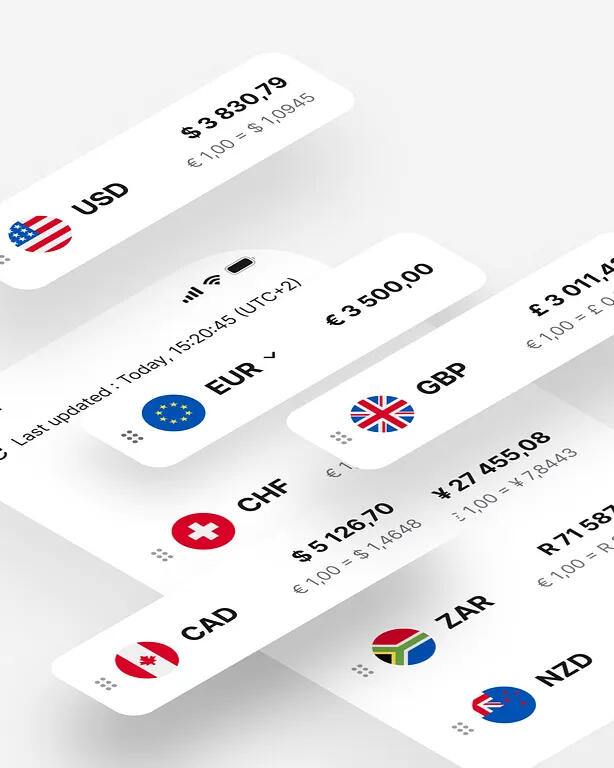

Multi-currency Accounts

Worldwide Presence, Local Expertise

Our multi-currency accounts simplify global transactions, allowing your business to securely receive and pay foreign currencies with a secure account in your business’ name. This streamlined solution makes cross-border payments easier for you, your customers, and suppliers.

Foreign Exchange

cross border payments

Enabling seamless international transactions by eliminating cross-border obstacles and burdens. Provide efficient payment solutions to foreign associates, partners, and customers

Advanced Bit Encryption

Safeguards Financial Data, Securely hosted offsite servers

Advanced Fraud Prevention

System Monitors Transactions in Real-Time to Safeguard Your Funds

Smart Technology lets you

Conduct transactions at spot rates or schedule for a future date

.

.

.

We provide the scale, security, and infrastructure essential for business growth and success.

Expand your business into global markets

We provide businesses with the fastest and most efficient payment pathways.

Unified Platform

Avoid opening local bank accounts abroad

Pay suppliers in their local currencies - Receive payments in local currencies - Convert received foreign currency payments - Manage all FX in one place - reducing conversions

Safeguard your cashflows and operate globally

No initial deposit required for FX hedges, with flexible mark-to-market thresholds, allowing you to effectively deploy cash in your business.

Stay ahead of shifts in the FX markets

intercompany Netting - Forward Contracts - Cross-Border API - Balance Sheet Hedging - Limit Orders - Leverage opportunities and safeguard your margins amid favorable currency movements.

Too bold for digital banks, too swift for traditional ones

A partner in global growth

Built for agility, powered by scalable technology, Tired of banking systems that can’t keep pace with your business.

Live fx

Global Invoice

Automation

Automate your accounts payable with our solution, enabling direct processing of international payments from invoices, spreadsheets, or documents to streamline your workflow.our process. Upon receiving invoices, we extract data, ensure compliance, apply a fixed exchange rate, and promptly send the validated file for flexible international payments.

streamlined payment process

An end-to-end solution that securely sorts, processes, and stores all payables information, integrating data processing, validation, approval routing, system integration, reporting, and beneficiary management into a single platform

Fixed payment dates, ex-rates

Choose to pay invoices immediately or set a future payment date based on cash flow. Alternatively, lock in a fixed exchange rate for six months to avoid currency fluctuations and eliminate the need to rush payments to vendors

Faster approvals and more control

Reduce follow-ups and prevent spend surprises through intelligent, layered approvals and transparent audit trails. eliminating overdue payments and manual data transfer

Freeing up time for financial tasks

Accelerate processing and gain control, something impossible with manual, paper-based methods. This allows your accounting team to shift focus from administrative tasks to critical analysis

Global Debit Cards

Maintain control over your global expenses by setting custom spend limits for employees. Create personalized approval workflows to regulate how your team spends company funds worldwide.Spend globally, just like a local. We’re transforming corporate spending. Empower your team to make payments in multi-currencies, without worrying about foreign transaction fees.Automation saves time in reconciliation, reduces errors and simplifies compliance

Swift, secure, and seamless

"Send secure global payments without fees and keep your business operations streamlined."

With physical and virtual cards for your team. Track expenses and manage multi-currency payments

Tailor the limits of each card based on your needs, Advanced spending controls on your card(s)

Benefit from no fees and high limits. Pay suppliers globally through our extensive network

Set up a virtual corporate card in just 5 minutes and receive instant notifications for every transaction

MiFID II

MiFID II Policy

Cross-Border Payments & Foreign Exchange Services

Last Updated: [March 2025] | Version: 1.0

1. Scope and Application

This policy applies to FX spot transactions, forwards, currency derivatives, and cross-border payment services. We reserve the right to decline services at our sole discretion and may restrict access based on jurisdiction, client profile, or market conditions.

2. Client Classification and Obligations

Retail Clients: Enhanced protection with suitability requirements Professional Clients: Reduced protection, presumed market knowledge Eligible Counterparties: Minimal protection, wholesale terms

All clients must:

• Provide accurate, complete information

• Maintain sufficient funds to cover potential losses

• Understand and accept substantial trading risks

• Comply with applicable laws and regulations

3. Risk Acknowledgment

By using our services, clients acknowledge that:

• FX trading involves substantial risk of loss exceeding deposits

• Leverage amplifies both gains and losses

• Market volatility can cause rapid, significant losses

• We are not responsible for market movements or client losses

• Past performance does not guarantee future results

4. Execution and Pricing

Best Execution: We aim for reasonable execution considering market conditions, liquidity, and order size.

Pricing Limitations:

• Prices are indicative and subject to market conditions

• Spreads may widen during volatility

• Execution prices may differ from quoted prices

• We do not guarantee price availability or execution

5. Product Suitability

Our products are designed for clients who have sufficient financial resources, understand FX risks, possess relevant experience, and can monitor positions regularly. Clients trading execution-only assume full responsibility for investment decisions.

6. Client Protection - Limited Scope

Fund Segregation: Client funds are segregated per regulatory requirements, but segregation does not eliminate all risks. We reserve set-off rights for outstanding obligations.

Compensation Scheme: Coverage subject to scheme rules, maximum limits, and exclusions. Compensation is not guaranteed.

7. Conflicts of Interest

We maintain conflict management policies but complete elimination is not possible. We may trade on our own account, receive payments from liquidity providers, and engage in market making activities that create inherent conflicts.

8. Costs and Reporting

Costs: All charges are disclosed but may change based on market conditions. Currency conversion costs vary and third-party costs are passed through.

Reporting: We fulfill regulatory obligations but accuracy depends on client-provided information. Clients are responsible for their own tax reporting.

9. Limitation of Liability

Service Disclaimer: Services provided "as is" without guarantees of availability or performance.

Liability Exclusions: To the maximum extent permitted by law, we exclude liability for:

• Market losses or missed opportunities

• System failures or technical issues

• Indirect or consequential damages

• Third-party service provider failures

• Regulatory changes affecting services

10. Regulatory Compliance

Authorisation: We are authorised and regulated by [Relevant Authority] under licence [Number].

Jurisdictional Limits: Services may not be available in all jurisdictions. Clients are responsible for local law compliance.

Policy Updates: This policy may be updated at any time with immediate effect upon website publication.

11. Contact Information

Compliance:[email protected]

Client Services: [email protected]________________________________________

LEGAL NOTICE: This policy constitutes a binding agreement. FX trading involves substantial risk and is not suitable for all investors. You may lose some or all of your investment. Seek independent advice if you do not understand these terms.

Anti-Money Laundering (AML) Policy

Version 1.0

1. Introduction

This Anti-Money Laundering (AML) Policy sets forth the internal controls and procedures adopted by corbanq.com (“we”, “our”, “us”) to detect, prevent, and report money laundering and terrorist financing activities. As a provider of cross-border payment and Foreign Exchange services, we operate in full compliance with applicable regulations in the United Kingdom, the European Union, and globally.We employ a risk-based approach to AML compliance and maintain high standards of transparency, accountability, and regulatory adherence.2. Legal and Regulatory Framework

Our AML framework aligns with relevant national and international legislation and guidance, including:United Kingdom- Proceeds of Crime Act 2002 (POCA)- Terrorism Act 2000- Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017 (as amended)- FCA Guidance for Cryptoasset BusinessesEuropean Union- 5th and 6th Anti-Money Laundering Directives (AMLD)- EU Regulation (EU) 2015/847 on transfer of funds- Markets in Crypto-Assets (MiCA) Regulation (2023)- Global Standards- FATF Recommendations- UN Conventions against transnational organized crime and corruption3. Customer Due Diligence (CDD) & Know Your Customer (KYC)

All customer onboarding is subject to Customer Due Diligence (CDD) procedures, applied prior to account activation. These are conducted exclusively by our regulated third-party partners, authorised under UK and EU financial regulations.For Individuals:- Full legal name- Government-issued photo ID- Proof of address (within last 3 months)- Date of birthFor Corporate Clients:- Company Registration Certificate (Issued by the relevant corporate registry)- Articles of Association / Incorporation Documents (Showing company structure, shareholders, and directors)- Recent Bank Statement (In the company’s name, dated within the last 3 months)- Proof of Business Address (if different from registration address) (E.g., utility bill, lease agreement, or official correspondence)Ultimate Beneficial Owner (UBO) and Director KYC (For each UBO and director, please provide:)- Valid Passport or Driving Licence (live photo only — no scans)- Proof of address (Utility bill or bank statement, dated within the last 3 months)- We do not perform direct KYC verification ourselves, but monitor and enforce KYC compliance through our partners.4. Enhanced Due Diligence (EDD)

EDD measures are applied in higher-risk situations, including:- Politically Exposed Persons (PEPs)- High-risk jurisdictions- Large or complex transactions- Suspicious behavior or activity- EDD may include additional documentation and approvals from senior compliance personnel.5. Transaction Monitoring

We maintain an independent, internal AML program, focused on monitoring all transactions executed via our platform. Monitoring is both real-time and post-transaction, designed to detect:- Unusual or inconsistent transaction patterns- Structuring or layering activities- Use of anonymization or mixing services- Unexplained activity spikes inconsistent with customer profiles6. Reporting Suspicious Activity

Suspicious transactions are reported to the appropriate authorities without prior notification to the customer, in compliance with anti-tipping-off regulations:- UK: National Crime Agency (NCA)EU: National Financial Intelligence Unit (FIU) of relevant member state- Internationally: Cooperation with competent law enforcement and regulatory bodies7. Record-Keeping

We retain KYC records, transaction logs, and compliance documentation for a minimum of 5 years following the conclusion of a customer relationship, in accordance with regulatory obligations.8. Sanctions Screening

We do not engage with individuals, entities, or jurisdictions subject to:- UK Sanctions List- EU Restrictive MeasuresAll customers and transactions are continuously screened against relevant sanctions lists throughout the customer relationship.9. Staff Training

All employees undergo regular AML training, covering:- KYC/CDD and EDD processes- Suspicious activity identification and reporting- Relevant regulatory frameworks in the UK, EU, and internationally10. Governance and Oversight

Our AML program is overseen by a Designated Compliance Officer, responsible for:- Ensuring the effective implementation of this AML Policy- Overseeing customer onboarding and transaction monitoring processes- Liaising with regulators and law enforcement authorities- Conducting internal audits and periodic AML risk assessments11. Delegation of KYC/Onboarding Responsibilities

At corbanq.com, all KYC and CDD procedures are exclusively performed by our licensed third-party partners, who operate under stringent UK and EU anti-money laundering regulations. While we do not directly conduct customer identification, we:- Monitor platform activity for suspicious or unusual transactions- Apply restrictions related to sanctions and high-risk jurisdictions- Cooperate fully with authorities, including filing reports when requiredOur compliance team works closely with our partners to maintain the integrity of our platform and ensure ongoing regulatory compliance.

Terms of Use

1 Introduction >> By utilizing our site, you affirm your acceptance of these terms of use and agree to adhere to them. If you do not consent to these terms, you should refrain from using our site. We recommend that you retain a copy of these terms for future reference.2 About Us >> www.corbanq.com, corbanq, "CQ", "us," "firm," all refer to and operated by Exio, registered at 75 Shelton Street, Covent Garden, London, United Kingdom, WC2H 9JQ3 Digital Platform and Customer Service >> We operate as a fully digital platform. All customer service inquiries, support requests, and general queries must be submitted through our designated online portal available on our website or via email to our customer service team [email protected]. We do not provide telephone support or in-person assistance.All correspondence and inquiries submitted through our portal or email will be handled and responded to within the same business day, subject to our operating hours and excluding weekends and public holidays. Response times may vary depending on the complexity of your inquiry.By using our platform, you acknowledge and agree to utilize only these digital communication channels for any customer service needs or queries.4 Accessing the Website >> We cannot guarantee the continuous availability or uninterrupted access to the site or any of its content. We retain the right to suspend, withdraw, or limit access to all or any part of the site for operational or business reasons. We will endeavor to provide you with reasonable notice of any suspension or withdrawal.We shall not be held liable for any period during which the site is unavailable.If you are provided with or choose a login, password, or any other security-related information, you must treat such details as confidential. We retain the right to deactivate any login or password, whether chosen by you or assigned by us, if we believe that you have violated any provisions outlined in these terms.Our site is made available to you at no cost. As the visitor to the site, it is your responsibility to make all necessary arrangements for accessing the site. Additionally, you are accountable for ensuring that all individuals who access the site through your internet connection are aware of and comply with these terms.5 Accuracy and Reliability of Information >> The content featured on our site is intended for general informational purposes only. It should not be considered as advice upon which you should base your decisions. Prior to taking any action or abstaining from it based on the content available on our site, it is imperative to seek professional or specialized advice.While we make reasonable efforts to maintain the accuracy and currency of the information on our site, we provide no assurances, warranties, or guarantees, whether explicit or implicit, regarding the accuracy, completeness, or timeliness of the content on our site.6 Our Liability >> This clause does not exclude or limit firm' liability for death or personal injury arising from negligence, fraud, fraudulent misrepresentation, or any other liability that cannot be excluded or limited by law.To the extent permitted by law, we disclaim all conditions, warranties, representations, and other terms, whether express or implied, that may apply to the site or any content on it. Therefore, your use of the site is undertaken at your sole risk, and corbanq.com shall not be held liable for any loss or damage of any kind arising from your use of or reliance upon the information contained on the site, to the maximum extent allowed by law.We do not guarantee or warrant that the site will be available, meet your requirements, operate without interruption, be free from delays, failures, errors, or omissions, prevent the loss of transmitted information, or be free of viruses or other harmful components that could damage your computer. It is your responsibility to ensure you have adequate data and equipment protection, as well as to take reasonable precautions to scan for computer viruses or other harmful components.We make no representations or warranties regarding the accuracy, functionality, or performance of any third-party software used in connection with the site.To the fullest extent permitted by law, we, along with our representatives, agents, and related entities, hereby disclaim all conditions, warranties, and other terms that might otherwise be implied by statute, common law, or equity.Furthermore, we shall not be liable for any direct, indirect, or consequential loss or damage incurred by you in connection with the site or its use, including but not limited to:

Loss of income or revenue.

Loss of business.

Loss of profits or contracts.

Loss of anticipated savings.

Loss of data.

Loss of goodwill.

Wasted management or office time.

Any other loss or damage of any kind, regardless of how it arises, whether caused by tort (including negligence), breach of contract, or otherwise, even if it was foreseeable.7 Computer Viruses, Hacking, and Other Offenses >> You are strictly prohibited from misusing the site by knowingly introducing viruses, Trojans, worms, bots, logic bombs, or any other form of malicious software.You must not attempt to gain unauthorized access to the site, the server where our site is hosted, or any server, computer, or database connected to the Site.Engaging in a denial of service ("DOS") attack or a distributed DOS attack against the Site is strictly prohibited. We will promptly report any such breach to the relevant law enforcement authorities and collaborate with them by disclosing your personal information. In case of such a breach, your right to use the site will be terminated immediately.We do not guarantee that the site will be secure or free from bugs or viruses. It is your responsibility to maintain up-to-date and effective anti-virus and anti-malware software on all your devices, including phones, tablets, computers, servers, and network infrastructure, through which you interact with us. If you suspect that any device through which you transact with us has been compromised by malicious software, you must notify us immediately by contacting us.We shall not be held liable for any loss or damage resulting from a distributed DOS attack, viruses, or any other form of malicious software that infects your computer equipment, computer programs, data, or other proprietary material due to your use of the Site or your downloading of any material posted on it, or on any site linked to it.We will also not be liable for any loss or damage incurred by you as a result of using public network connections, failing to maintain up-to-date and effective anti-virus and anti-malware software, or failing to notify us of any infection of your device by malicious software.8 Hyperlinks from Our Website >> When our site includes links to other sites and resources provided by third parties, these links are offered solely for your information. We exercise no control over the content of those sites or resources and bear no responsibility for them or for any loss or damage that may result from your use of them. It is important to note that we have no control over the content of those sites or resources.9 Jurisdiction >> If you are a consumer, it's important to understand that these terms of use, their subject matter, and their formation are governed by the laws of England and Wales. Both you and we mutually consent to the exclusive jurisdiction of the courts of England and Wales.If you are a business, these terms of use, their subject matter, and their formation (including any non-contractual disputes or claims) are also subject to the laws of England and Wales. We both concur with the exclusive jurisdiction of the courts of England and Wales.10 Revisions to These Terms and the Website >> We periodically make amendments to these terms. Whenever you intend to use our site, kindly review these terms to ensure your understanding of the terms in effect at that moment.We may periodically update and modify our site to align with changes in our products, the needs of our users, and our business priorities. We will make reasonable efforts to provide you with advance notice of any significant changes.Updated on - March 2025

Privacy Policy

At corbanq.com, we are committed to protecting your personal information. In accordance with relevant legislation, including the General Data Protection Regulation, we diligently strive to minimize the collection and utilization of personal data to what is essential for the smooth operation of our business.As a user of the website, you have certain rights, including:Right of Access: The right to access any personal information we hold about you.Right to Rectification: The right to correct any inaccuracies in your personal data or complete any incomplete information.Right to Erasure: The right to request the erasure of your personal data (please note exceptions may apply).Right to Object: The right to object to how we use your personal information (please note exceptions may apply).Should you wish to exercise any of these rights, please submit your request via email to [email protected] We strive to respond to all such requests within 4 Weeks of receipt.Information We Collect when you reach out to us through this website:Your nameYour company's nameYour trading nameYour website URLYour phone numberYour email addressYour addressAny additional information you provide in the body of your message is optional. This information is requested solely if you use our online contact forms.Furthermore, we employ Google Analytics to monitor website traffic and user engagement. This tool exclusively gathers aggregated data and does not store personal information about individual users. Additionally, we utilize cookies to enhance your online experience.How We Use Your InformationPersonal information submitted via our online enquiry forms will exclusively be used to respond to your inquiries.The anonymous data we collect using Google Analytics serves to measure and enhance the performance of our website.All personal information is securely held. We do not rent, sell, or transmit personal information to other organizations.Links to Other WebsitesWhile our website may contain links to other sites, we make every effort to link exclusively to sites that share our high standards and respect for privacy. Nonetheless, we do not assume responsibility for the content or privacy practices employed by other websites, and we accept no liability for any personal information you provide on websites other than corbanq.comInformation SecurityTo ensure the security of information submitted via this website, we employ the services of a SSL certificate.FraudWe takes internet fraud seriously. If we have reason to believe that a crime is being committed or that our website has been abused in any way, we reserve the right to share pertinent information with law enforcement and fraud prevention agencies, including banks.Updated - March 2025

Cookie Policy

MiFID II Policy

Anti-Money Laundering (AML) Policy

news

complaints policy

Complaint Handling Policy

Corbanq.com (“Corbanq”, “we”) is committed to providing excellent customer service and handling complaints fairly, promptly, and transparently. This policy outlines how we manage complaints in line with Financial Conduct Authority (FCA) rules.What is a Complaint?

A complaint is any expression of dissatisfaction, spoken or written, from a client or potential client about our services or staff conduct.Our Principles

We follow these core principles:

Accessible – Clients can easily submit complaints.

Fair – All complaints are handled impartially.

Efficient – We aim for quick resolutions.

Transparent – Clear communication throughout the process.

Accountable – We track and review complaints.

Improvement-focused – We use complaints to enhance our services.How to Complain

Send complaints to: 📧 [email protected]

Addressed to the Compliance Department.

Please include your account info and full details of the issue.Complaint Process

Acknowledgment – We’ll confirm receipt within 5 business days and share next steps.

Investigation – Our Compliance Team investigates impartially and may request more info.

Resolution – We aim to resolve within 15 business days. If more time is needed, we’ll keep you updated. A final written response is sent within 8 weeks.

Escalation – If unresolved or unsatisfactory, eligible clients (consumers, small businesses, charities) may contact the Financial Ombudsman Service (www.financial-ombudsman.org.uk) or the FCA (www.fca.org.uk / 0800 111 6768).Staff Training & Reporting

Staff are trained to handle complaints professionally. We log all complaints, track trends, and report to senior management to ensure ongoing improvement and compliance.Policy Review

We regularly review this policy, adapting to feedback, regulatory updates, and audit findings to continually improve our service.

simplify your operations

Welcome to corbanq.com,

A leading foreign exchange company specializing in cross-border payments. With the ability to transfer in 140 currencies to over 200 countries, we are committed to delivering seamless and efficient global transactions for businesses worldwide.

About us

At the heart of our service is a dedicated team of customer support professionals and world-class technology that ensures your payments are processed swiftly and securely. Trusted by businesses, giving you the confidence and reliability you need for your cross-border transactions.Our specialists possess deep industry knowledge and take a personalized approach to crafting solutions tailored to the specific needs of your business. Whether you need to protect assets and liabilities in foreign currencies, manage risk, or gain flexible exposure to the market, we’ve got you covered.We pride ourselves on being reliable payment experts who ensure your payments are delivered in full and on time, every time.We cater to a wide range of industries, including entertainment companies, funds and institutional clients, healthcare providers, law firms, NGOs, payroll services, International trade and sporting organizations.Whatever your business, we have the expertise and technology to support your cross-border payment needs. Let us help you streamline your international transactions while ensuring peace of mind with our trusted services.

skyrocket your business

We combine deep expertise in the currency market with a genuine passion for helping our clients grow and reach their full potential.Our cutting-edge technology delivers powerful operational support, enabling smarter, faster, and more effective decision-making.

General Enquiries Information

Monday-Friday

09.00 am - 17.00 pm (GMT)

[email protected]

All general enquiries please contact us using the details above

Customer Support & Compliance

[email protected]

Marketing & PR

[email protected]

Complaints

[email protected]

We're committed to excellent service. If you're unhappy with our services or staff, please email us.

View our: complaints policy

Leave a message

Registration

By clicking Next you confirm that you have read and understood the corbanq privacy policy and agree to be contacted about your account application.Your business details are required to ensure compliance with financial industry standards and regulatory requirements. Please provide accurate information below.No setup Fees - No Monthly FeesAll Applications will be subject to KYC and KYB checks.

currency account

Global Debit Card

Invoice Payment

Login

"Our platform is built to reduce the complexities involved in cross-border transactions."Send and receive money effortlessly—any currency, any country.

Login Link

"Upon activation, you will receive an email with a link to access your business account."

To request your login link, contact customer support at

[email protected]

Empower stablecoin-payments

Near instant payments that enhance cash flow and provide flexibility

Expand into new markets with stablecoins, enabling sellers to access a broader customer base through digital currencies.Enabling seamless cross-border transactions, allowing you to send and receive funds efficiently, regardless of the currency or time of day.

USDT | USDC | PYUSD | xrp | btc | ETH | SOL

Pay-using Stablecoins

USDT | USDC | PYUSD | xrp | btc | ETH | SOL

Meet rising demand for stablecoin payouts. Expand into new markets through digital payments. Optimize payouts by reducing intermediaries and increasing speed.

Market data shows a significant uptick in freelancers across more than 100 countries choosing stablecoins, both as a payment and payroll option - for faster, more reliable payouts

Streamline payouts

By eliminating multiple intermediaries and enabling real-time efficiency

Give more choice

Let them receive payments in the currencies they want - securely, efficiently, and globally